Legislation and regulations stipulate that digital services provided by companies to consumers must be taxed with VAT (Value-Addex Tax).

There is an exemption to this for companies. To make use of this exemption we have explained in this article how you can fill in your company details and Tax ID to get an exemption from the VAT charge.

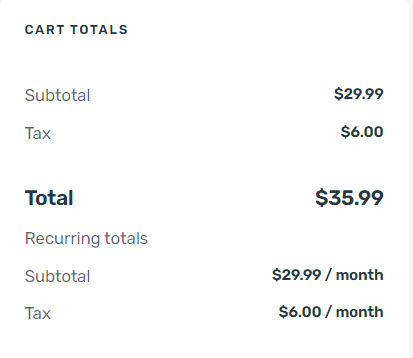

Step 1: First of all, you have to select the desired subscription via the pricing page. Note! During the selection, the amount including VAT is displayed.

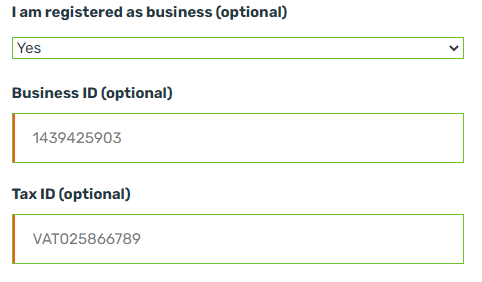

Step 2: Then you go to the check-out page and then you can enter your details on this page. It is important that you enter this information correctly. Then you have to select yes at the option ‘I am registered as a business’ and then fill in the VAT data.

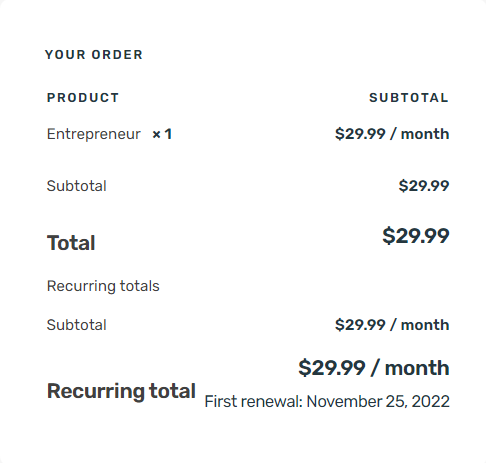

When you have entered the data correctly, the VAT charge will be adjusted to 0%.

If you still have any questions, please don’t hesitate to contact our support department!